With the housing market going through a re-adjustment period in the last 12 months, one key factor has been interest rates.

With its recent peak of 5.25%, there’s a growing anticipation that the current rate set by the Bank Of England may have hit its ceiling. The hopeful whispers in economic circles suggest the possibility of base reductions in the near future, potentially as early as the spring of 2024. This prediction stems from the convergence of factors such as decreasing inflation and a semblance of stability in the market.

However, one development amidst this anticipated drop is the emergence of what appears to be an “Interest Rate Price War” among high street lenders. With lenders eager to entice more business and capitalise on impending changes, these lenders are actively slashing their fixed-rate offerings.

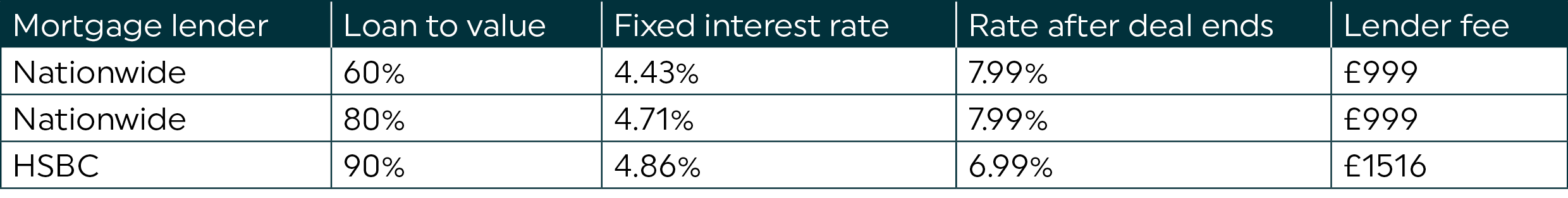

In fact, the latest data for 5 year fixed deals include;

These are the lowest 5 year fixed deals in the last 12 months, coming down from July and August highs whilst rates were still being adjusted by the Central Bank.

Benefits of rate reductions

In short, cheaper mortgages means there is more money in your pocket at the end of each month – whether that is new homebuyers or remortgaging from deals which may have been a temporary solution.

However, navigating this landscape requires insight and expertise.

This is precisely where speaking with a Mortgage Adviser becomes invaluable. Their specialised knowledge and understanding of the market nuances allow them to provide tailored guidance. Engaging with an adviser can shed light on how these rate reductions might directly impact your financial plans. Whether you’re contemplating buying your first home, considering an upgrade, or even contemplating refinancing, their insights can offer clarity in making informed decisions.

For instance, a reduction in fixed rates might mean lower monthly payments for new borrowers, potentially making homeownership more accessible. Similarly, for existing mortgage holders, this presents an opportune moment to explore the potential benefits of refinancing at a more favourable rate.

Due to the ever shifting nature of the market and the different offers available, advisers can give you informed insights and unbiased advice as to the kinds of deals. In many cases, advisers can pass you onto brokerage teams who can get better offers than retail providers.

Unpredictable economic shifts and things like a Central Bank decision impacting mortgage rates, advisers can provide comfort and reassurance in these market conditions – making them a good option to speak to when purchasing a home.

With whispers of base rate reductions and the ensuing interest rate competition among lenders hint at a promising shift in the mortgage landscape. Being able to capitalise on this opportunity requires solid financial planning. Engaging with a Mortgage Adviser allows you to align your goals with the evolving financial environment, potentially paving the way for more favourable mortgage terms and financial security.

Don’t miss the chance to explore how these rate reductions could positively impact your future mortgage plans—reach out to our Mortgage Adviser today for personalised guidance tailored to your financial aspirations.