Whether you are buying or selling your home, understanding what is going on when it comes to house prices is going to be of the utmost importance. Granted, we are an independent estate agents based in Chester so we should know a thing or two about house prices locally – and we do.

That’s what multiple years of experience brings to our team, and with our track record of the most amount of sales in the CH1, CH2 and CH3 postcodes, we not only know about the area, but what makes them so special and marketable.

There has been a lot of talk recently about “house prices dropping” and “house prices increasing for the first time in 6 months.”

We thought we would spend the time dispelling the myths and breaking down what is really happening in the housing market to give you the best possible insight before making any decisions.

Understanding the Current Shifts in House Prices

It’s safe to say that since the global pandemic of 2020, nothing has felt the same – especially when it comes to the housing market. What was seen as a huge market bubble at the time, with people moving and getting record highs for their homes, more recently, we have been experiencing a somewhat more turbulent effect in the market landscape.

These changes can be explained by the factors which affect house prices.

Factors Influencing House Prices

From interest rates, the overall health of the economy to the fundamental dynamics of supply and demand, house prices are heavily influenced by these three areas.

1. Interest Rates:

Interest rates, set by central banks, play a pivotal role in influencing house prices. Lower interest rates encourage borrowing, thereby increasing demand for mortgages and homes. Conversely, higher rates can stifle demand as borrowing becomes more expensive, leading to a potential slowdown in the housing market.

December 2021 saw record low interest rates of 0.25%. Since then, we have seen 13 rate increases setting a 16 year high of a 5.25% base rate.

The cheapest 5 year fixed mortgage on offer today (16/11/23) is a 4.53% from the Halifax building society. However, in June 2021 it was 1.75%.

2. Health of the Economy:

The overall economic health of a region or country can significantly impact house prices. A robust economy with steady job growth and rising incomes often stimulates housing demand, leading to an increase in prices. Conversely, economic downturns or uncertainty may result in reduced demand and stagnant or declining house prices.

We have been through a cost of living crisis in the last 14 months, we have seen inflation peak at 14.8% in October 2022. The good news is that inflation is now at its lowest at 4.7% which is still over the Bank of England target of 2% per annum.

The UK has also managed to avoid a recession (as of writing 16/11/23) but it is forecast to not grow for 2024, and see a 1% growth rate in 2025. These are weak figures right now but as with all economics, things can change quickly.

3. Supply and Demand Dynamics:

The classic principle of supply and demand plays a crucial role in the housing market. Limited housing supply in the face of high demand tends to drive prices upward. Conversely, an oversupply of housing relative to demand can lead to price reductions as sellers compete for buyers.

We have experienced the classic, demand outstripping supply for the last three years in Chester and wider areas too. This is fuelled by many selling in the highs of the housing market of 2020 and not being able to find homes since, instead opting to rent or downsize into smaller properties for a shorter period of time.

“When you factor in what has been happening on a wider scale, you start to see where house prices can be affected. From the record highs following the pandemic to the price drops today, it’s normal that the housing market would need to find it’s own feet again and stabilise somewhat differently in these extraordinary times.” Gareth Friend.

Comparative Analysis of House Price Indices

If you get confused when you read one headline saying, “house prices stayed the same” and others saying “house prices dropped”, you’re not alone. A lot of this is fuelled by different house price indices.

To gauge the pulse of the housing market, various indices, such as the Nationwide House Price Index, Halifax House Price Index, and Rightmove House Price Index, serve as barometers. Each index employs distinct methodologies and data sources to track and report on house price trends, offering unique insights into market dynamics.

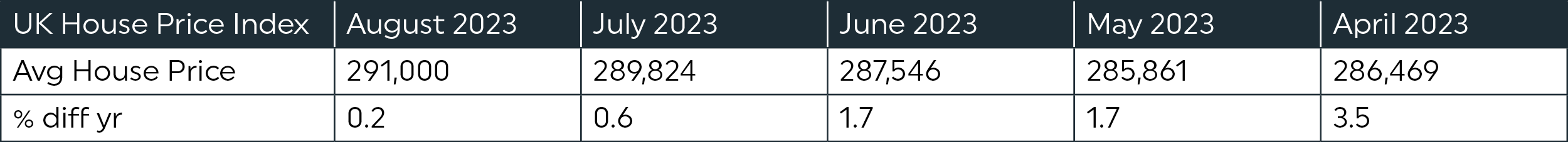

– UK House Price Index:

The UK HPI provides a detailed and accurate representation of house price trends, allowing for a comprehensive analysis of the housing market’s performance on a national, regional, and local level. It considers various property types, such as detached houses, semi-detached houses, terraced houses, and apartments, providing a nuanced view of the market.

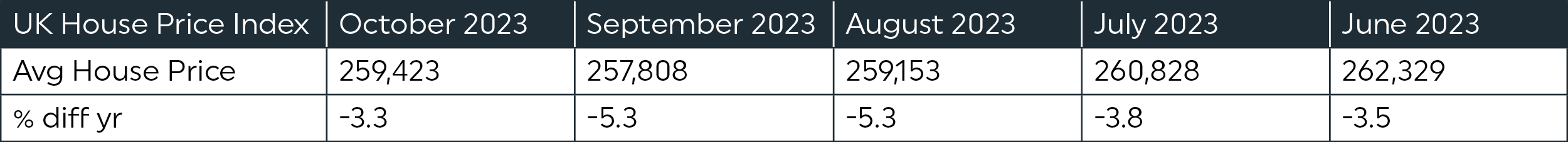

– Nationwide House Price Index:

Nationwide’s index provides a comprehensive view of house price fluctuations in the UK. It tracks changes in average house prices, offering valuable insights into national trends over time.

Whilst house prices have dropped from their highs in 2021, The Nationwide index reports a 0.3% increase in August which was from a 0.5% increase in July.

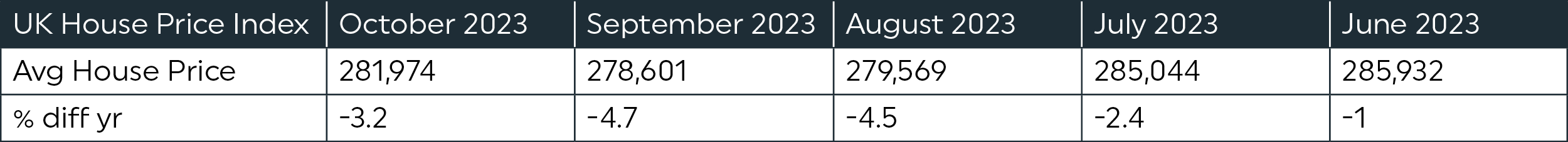

– Halifax House Price Index:

Halifax’s index focuses on housing market data, providing detailed analyses of prices, mortgages, and housing market trends. It aids in understanding regional variations and market shifts.

The Halifax has reported a 0.9% increase in house prices in the last quarter, but cautions that the market is still weaker than previous years.

– Rightmove House Price Index:

Rightmove’s index emphasises real-time data, capturing asking prices rather than finalised sale prices. This perspective offers immediate insights into seller expectations and market sentiment.

Rightmove puts the stabilisation of prices this year thanks to the better stability of the mortgage market which is passing on better long term fixed deals which it wasn’t before.

“What these indices show us is that the UK housing market is finding its new price range. So the highs of 2021 are going to be some way away, but we are comparing the highs to a new range, and not exactly a crash. Naturally, with the mortgage rates increasing, the demand for homes dropped because mortgages became more unaffordable.” Samantha Carman.

“We have to remember that we had incredible rates for over a decade following the 2009 financial crisis. This changed the market and home buying became more affordable with monthly payments – now, we face higher rates which influences affordability for the rate term.” Gareth Friend

Is Now the Right Time to Move?

Deciding whether it’s the opportune moment to move involves more than just analysing house prices. Homes are not solely financial assets; they are the spaces where families grow, memories are made, and futures are built. While considering the market’s fluctuations is essential, personal circumstances, lifestyle changes, and emotional attachments should also factor into the decision.

Evaluating Your Property’s Worth

Determining the value of your house involves a blend of market analysis and property specifics. Utilising tools like online valuation calculators, consulting with real estate professionals, and assessing recent sales data in your area can provide a clearer picture of your home’s worth.

Final Thoughts

We thought we’d leave the final thoughts with Samantha and Gareth when it comes to the question, “what’s going on with House prices?”

Samantha

“It’s easy to see house price drops on social media and read headlines in the paper and jump to conclusions. All the data shows is that the UK housing market is going through a new range of pricing. Trying to guess what a house may be in 6 months is not the best way to operate.

It would be more sensible to get experienced estate agents like ourselves to view your property and give you insight into what it is worth for market value. The age of your property, what the local area has, the state it’s in, they all play a factor in determining your house worth as well as these other things which are critical to pricing correctly.”

Gareth

“It’s become very knee jerk of late to see a headline and think your house is 15% less than it was a year ago. The data doesn’t support it, and in fairness, the market doesn’t either. If you’re buying, you could trick yourself to think that, but as Sami has said, what state is the house in? What area are you moving to? These play a critical role in your house purchase.”

“There is talk that rates will begin to get cut in June of 2024 and if that’s the case, we’ll start to see the market respond differently, again.”

“House prices will always fluctuate, but getting a good indication of what your home is worth is the first and best decision you can make.”

In conclusion, the rollercoaster ride of house prices is a multifaceted interplay of economic, societal, and personal factors. Understanding these dynamics, leveraging diverse indices for insights, considering the broader context beyond financial aspects, and conducting thorough evaluations are crucial steps in navigating the ever-evolving world of house prices.